Data flows and the Digital Decade

Foreword

International data flows are vital to Europe’s economic success. Setting the right framework for data flows now can have a huge positive impact on our economy by 2030.

The European Commission recently launched its targets for the Digital Decade. Among them were that by 2030:

- 75 per cent of European enterprises should have taken up cloud computing services, big data and artificial intelligence.

- Europe should double its number of unicorns.

- More than 90 per cent of European SMEs should reach at least a basic level of digital intensity.

Underpinning each of these goals is the need to be able to transfer data smoothly and securely across borders. This study demonstrates that even in a limited assessment – by looking only at international trade – cross-border data transfers can have a huge positive impact on the economy by 2030 if we make the right decisions now.

The growth of the digital economy and the success of European companies is dependent on the ability to transfer data. This is especially so when we note that already in 2024, 85 per cent of the world’s GDP growth is expected to come from outside the EU.[1] Our study shows that we could be missing out on around €2 trillion worth of growth by the end of the Digital Decade. This is roughly the same size as the Italian economy any given year.

Restrictions on cross-border data flows affect companies of all sizes and sectors. The EU manufacturing sector stands to lose the most in absolute value – indeed, more than half of our total losses from data restrictions. As SMEs account for almost a quarter of all goods exported from the EU, they will be heavily impacted. Sectors such as media and culture are some of the most impacted in relative terms, losing about 10 per cent of their exports. These are some of the industries that have made Europe what it is today.

A great example is that of our member Airbus. The latest A350 has 50,000 sensors on board collecting 2.5 terabytes of data every day. It shows just how much data has penetrated into traditional industries.

Data transfers are not only a key aspect of international trade, the value of which we have attempted to capture in this research, but are crucial for economic activity more at large. For example, moving HR information from a subsidiary to a parent company, transferring health data for ground-breaking research, or simply being able to use the perfect application for the tasks you need to do. Hampering the data flows behind these business decisions has a negative impact on all companies’ economic prospects.

Europe stands at a crossroads. It can either set the right framework for data transfers, and win the Digital Decade, or it can follow its current trend and move towards data protectionism, and lose. Our analysis shows that the consequences of these decisions will have a huge impact on exports, jobs and growth, and will ultimately define whether Europe can reach its ambitious industrial and digital goals.

Table of content

Overview of findings

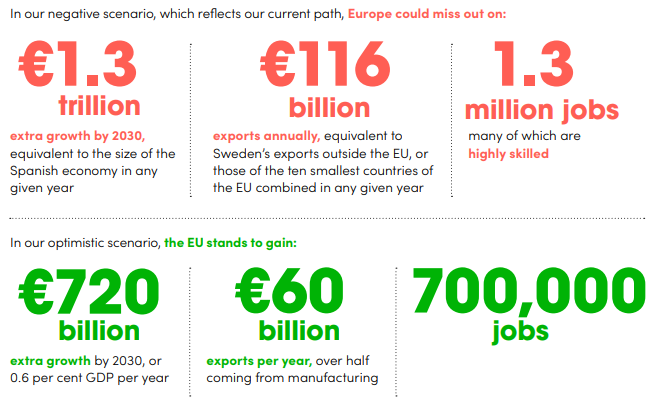

A study commissioned by DIGITALEUROPE and conducted by Frontier Economics shows that our policy decisions on international data transfers now will have significant effects on growth and jobs across the whole European economy by the end of the Digital Decade.

The study identifies sectors in the EU that rely heavily on data, and calculates the impact of restrictions to cross-border transfers on the EU economy up to 2030. These digitising sectors, across a variety of industries and business sizes, including a large proportion of SMEs, make up half of EU GDP. They are crucial to the Digital Decade’s goal of enabling the digital transformation of businesses, and to companies’ recovery across Europe as part of the EU’s Industrial Strategy.

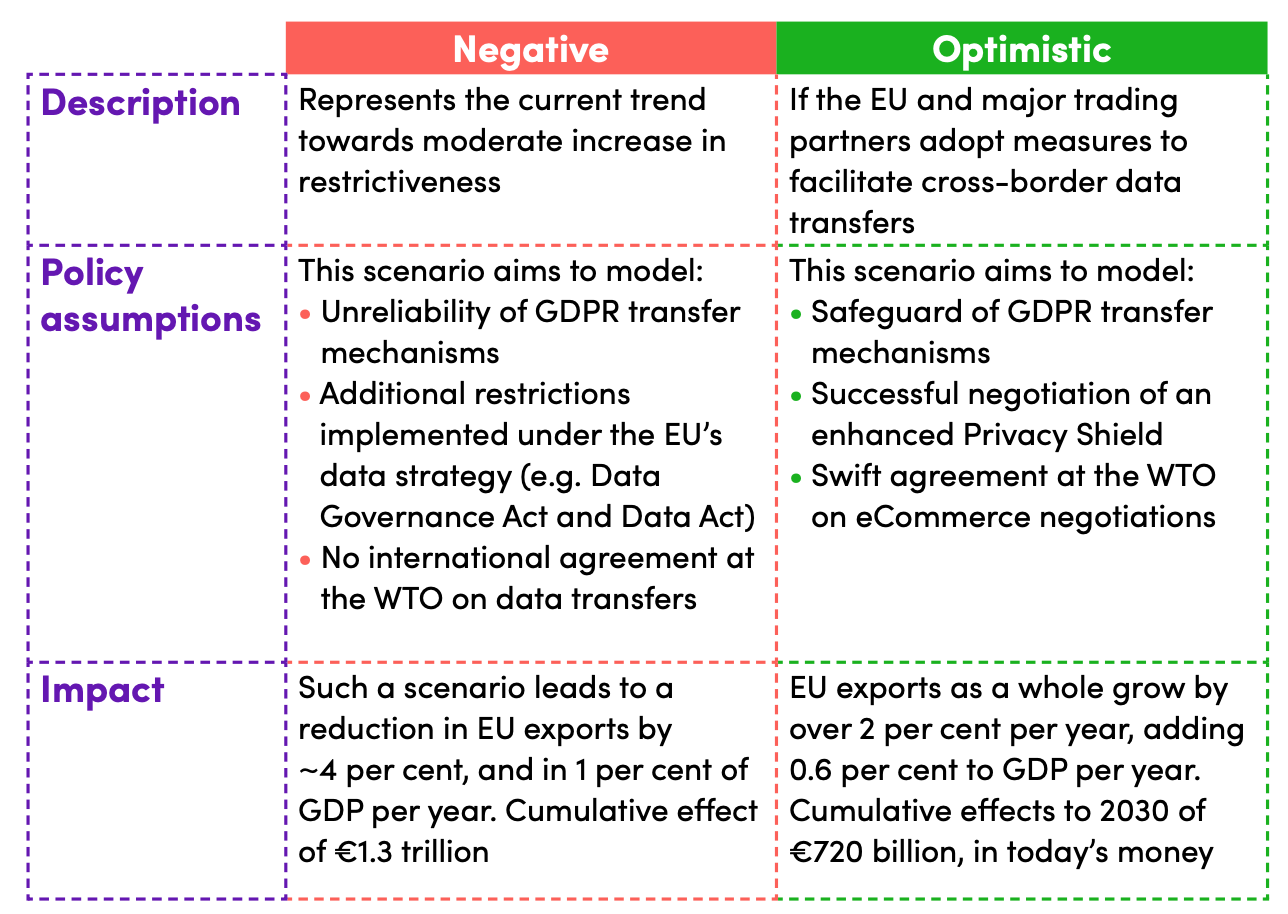

The study looks at two realistic scenarios, closely aligned with current policy debates. The first, ‘negative’ scenario takes into account current restrictive interpretations of the Schrems II ruling from the Court of Justice of the EU, whereby data transfer mechanisms under the GDPR are made largely unusable. It also takes into account an EU data strategy that places restrictions on the transfers of non-personal data abroad. Further afield, it considers a situation where major trade partners tighten restrictions on the flow of data, including through data localisation.

In the second, ‘optimistic’ scenario, we look at what would happen if the EU safeguarded GDPR data transfers and managed to secure an international agreement on data flows at the World Trade Organization (WTO) that would lead to some degree of liberalisation.

The study shows that:

- Overall, Europe could be €2 trillion better off and gain two million jobs by the end of the Digital Decade if we reverse current trends and harness the power of international data transfers. This is roughly the size of the entire Italian economy any given year.

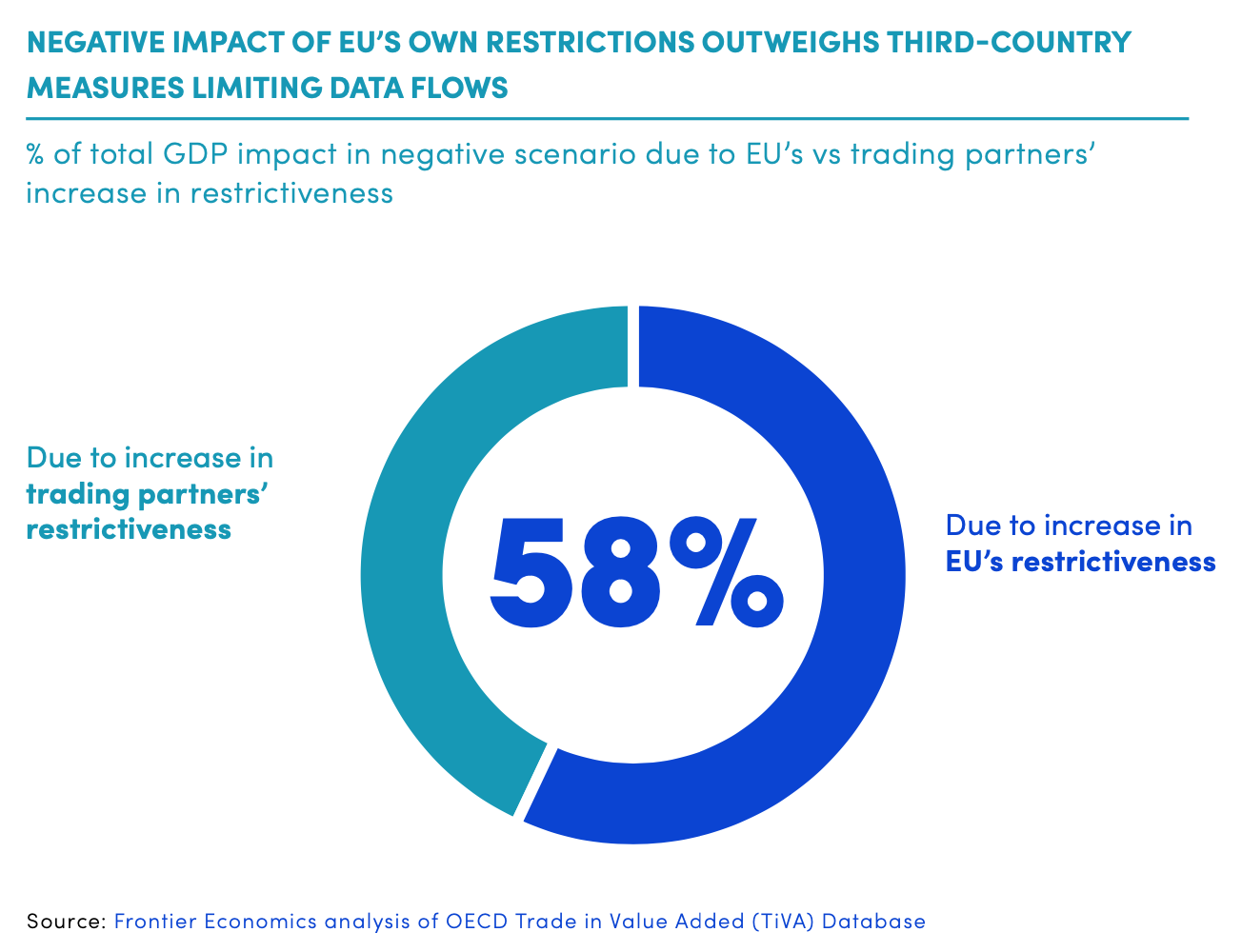

- The majority of the pain in our negative scenario would be self-inflicted. The effects of the EU’s own policy on data transfers, under the GDPR and as part of the data strategy, outweigh those of restrictive measures taken by our major trade partners.

- All sectors and sizes of the economy are impacted across all Member States. Data-reliant sectors make up around half of EU GDP. In terms of exports, manufacturing is likely to be hit the hardest by restrictions on data flows. This is a sector where SMEs make up a quarter of all exports.

Key findings

The difference between the two scenarios is € 2 trillion in terms of GDP for the EU economy by the end of the digital decade

- The sector that stands to lose the most is manufacturing, suffering a loss of €60 billion in exports. Proportionately, media, culture, finance, ICT and most ‘business services,’ such as consulting, stand to lose the most – about 10 per cent of their exports. However, these same sectors are those that stand to gain the most should we manage to change our current direction.

- A majority (around 60 per cent) of the EU’s export losses in the negative scenario come from an increase in its own restrictions rather than from third countries’ actions.

- Data localisation requirements could also hurt sectors that do not participate heavily in international trade, such as healthcare. Up to a quarter of inputs into the provision of healthcare consist of data-reliant products and services.

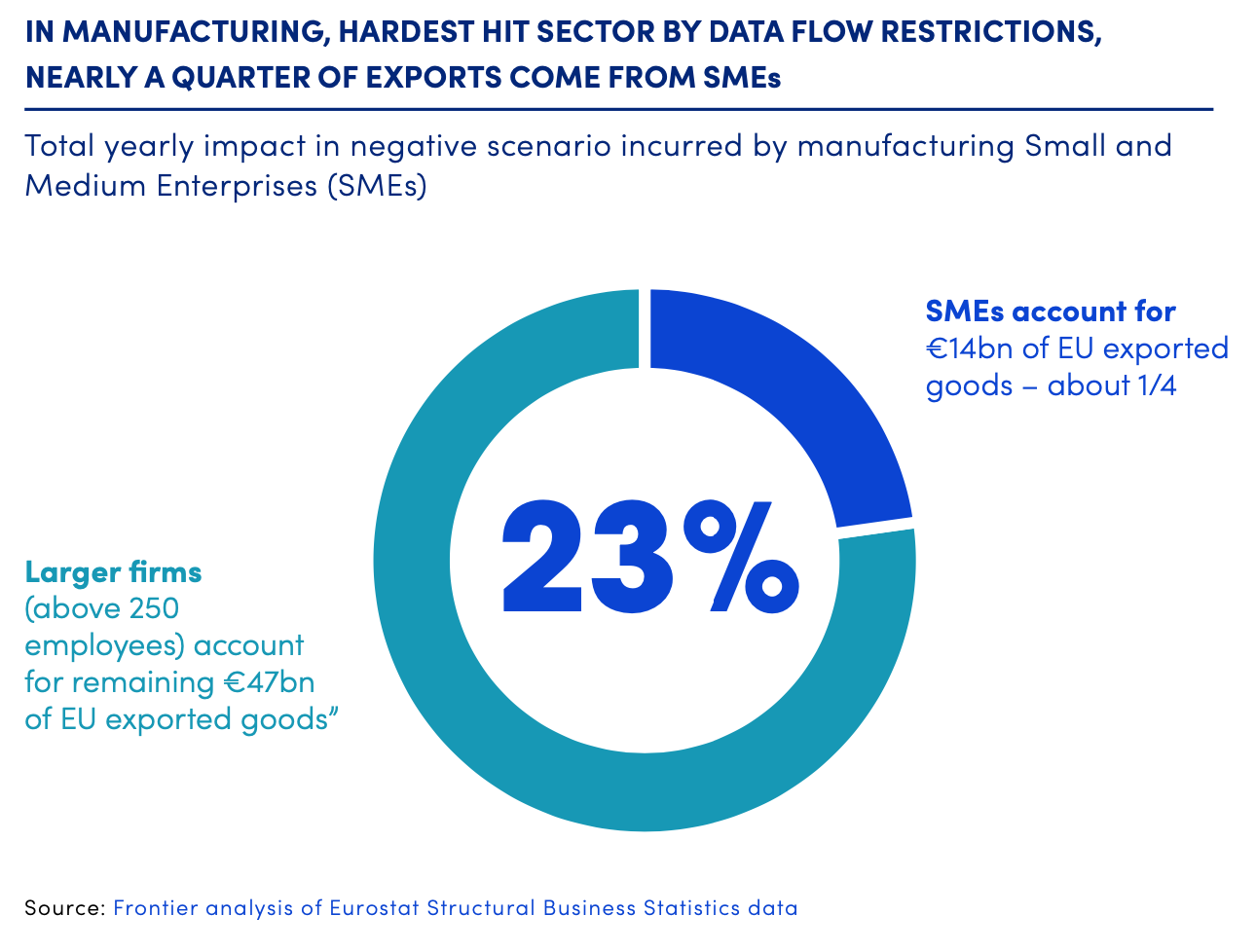

- In the major sectors affected, SMEs account for around a third (manufacturing) and two-thirds (services such as finance or culture) of turnover. Exports by data-reliant manufacturing SMEs in the EU are worth around €280 billion. In the negative scenario, exports from EU SMEs would fall by €14 billion, while in the optimistic scenario they would increase by €8

- Data transfers will be worth at least €3 trillion to the EU economy by 2030. This is a conservative estimate because the model’s focus is international trade. Restrictions on internal data flows, e.g. internationally within the same company, mean this figure is likely much higher.

Policy recommendations

The results of the study outline two very different paths forward. On the one hand, the current trajectory of the EU and its partners, namely a moderately restrictive scenario in which the EU restrains the usability of GDPR transfer mechanisms and introduces further conditions for transfers of non-personal data, and in which trade partners increase their overall levels of restrictions on cross-border data flows. On the other hand, a hopeful scenario where the EU and major trade partners adopt measures to facilitate cross-border data transfers. The difference between the two amounts to a cumulative difference of €2 trillion by 2030, or 1.5 per cent of the EU’s GDP.

The EU should:

Study methodology

The data in this report is based on an econometric study carried out by Frontier Economics based on OECD trading data. The economic impact is calculated by considering data flow restrictions as an increased cost to the international trade of data-reliant industries. Data-reliant industries, as defined by the OECD, represent about half of the European economy. This is a conservative assessment as it does not take into consideration, among other elements, the impacts of restrictions on intra-company data flows (which we know to be significant, but difficult to model) and other policy measures that might accompany data localisation. The study was commissioned by DIGITALEUROPE, and not sponsored by any individual member. The full Frontier Economics study, including an in-depth description of the methodology, can be accessed here.

Read the full study by Frontier Economics

1. The EU stands at a crossroads. It can either safeguard international data flows and win the Digital Decade, or limit them and lose

The difference between moderate restriction and a clear framework to safeguard international data flows is equivalent to €2 trillion by 2030, or 1.5 per cent of GDP per year. This also represents the loss of 1.3 million highly skilled jobs.

The yearly impact is equivalent to about two-thirds of the value of the EU’s pre-pandemic data economy.

*All scenarios measured against current situation as baseline, assuming GDPR transfer mechanisms apply.

We also attempted to calculate the overall value of international data flows to the European economy. This was done by modelling what would be the economic impact on EU trade of going to the maximum level of restrictiveness, in both the EU and third countries. While this approach is limited in that it focuses on trade and doesn’t account for all the cascading effects of international data flows on the whole economy, it does give a conservative estimate of how much current levels of cross-border data flows are worth to the EU. This approach suggests that the impact of a loss of cross-border data flows on exports from data-reliant sectors would lead to an annual reduction in EU GDP worth €330 billion, or around 2.5 per cent of total EU GDP.

Even though the figures above are significant, they remain conservative.

This is because the study:

- Calculates the economic impact by analysing transactions between firms. The significant impacts of data restrictions on internal flows, i.e. intra-company, are therefore not captured.

- Does not model all policy measures that affect data flows. For instance, localisation requirements in terms of business operations, limitation on the legal structure of data providers or ownership restrictions are not taken into account.

- Does not take into account the longer-run effects of data restrictions on the EU’s innovation capacity or its productivity. For example, research and development activities and product testing often occur through cross-border value chains that involve large-scale flows of different types of data (industrial, IP and personal data).

- Does not take into account that the structure of the EU economy may change or that sectors may become increasingly reliant on data. The model only looks at the trade impact on data-reliant sectors as they were defined by the OECD in 2015.

2. Most of the pain would be self-inflicted. Adopting restrictive measures in the EU, from GDPR interpretations to data strategy measures, would severely harm the EU’s economy

The effects of the EU’s own restrictions on cross-border data flows play a predominant role compared to measures taken by third countries. This underlines the importance of getting major policy decisions right. Notably, achieving a realistic assessment of what supplementary measures are necessary under GDPR transfer mechanisms, achieving strong adequacy decisions, and making sure that provisions in the Data Governance Act and the Data Act do not impose undue requirements on international data flows.

The study, however, also underlines the importance of securing the right framework for data transfers in international trade agreements with the EU’s trading partners. This can be done through a successful definition of data flows language as part of the WTO eCommerce negotiations, and through bilateral agreements. The top ten countries the EU sends more data to and from are the US, the UK, China, Switzerland, Japan, Russia, India, Turkey, Korea and Brazil. Together they account for about two-thirds of the value of data transfers worldwide.

EU losses from restrictions to US transfers and wins from relaxed measures in China are considerable.

- The US is the EU’s largest data partner. It is the partner with whom the EU stands to lose most from increases in restrictiveness. This underscores the importance of a strong negotiation of an enhanced Privacy Shield, and of further transatlantic collaboration on technology and trade.

- China is the EU’s third largest data partner. It is also the trading partner where the EU stands to gain the most from the establishment of the right international trade framework for data transfers.

3. Data-reliant companies from all sectors and sizes stand to win or lose

International data flows are essential across the EU’s data-reliant economy: all countries, sectors and firm sizes would be significantly impacted both in the negative and optimistic scenarios.

In absolute terms, manufacturing would be the hardest hit sector, losing €61 billion every year – more than half of total losses. In relative terms, ICT, media, culture, business services, finance and telecoms would be most impacted, losing about 10 per cent of their exports.

Critical EU industries are in the line of fire. Manufacturing is hardest hit in absolute terms, while ICT, media, culture, business services, finance & telecoms each lose 10per cent of their exports.

Data flow restrictions impact all European countries, reducing exports by 4% on average

The effect of data policies on SMEs is also likely to be significant. This is because data policies often impose fixed costs on businesses, and smaller firms have usually a harder time absorbing those fixed costs than larger companies. In addition, SMEs account for a significant proportion of the EU’s exports from data-reliant sectors.

For instance, in the case of manufacturing, SMEs account for 23 per cent of goods exported from the EU.